Property Taxes in Harris County Increase to Help Recover from Disasters

Property tax increases are typically put to a vote by residents, but there are exceptions allowed by state law, particularly in the case of declared disasters.

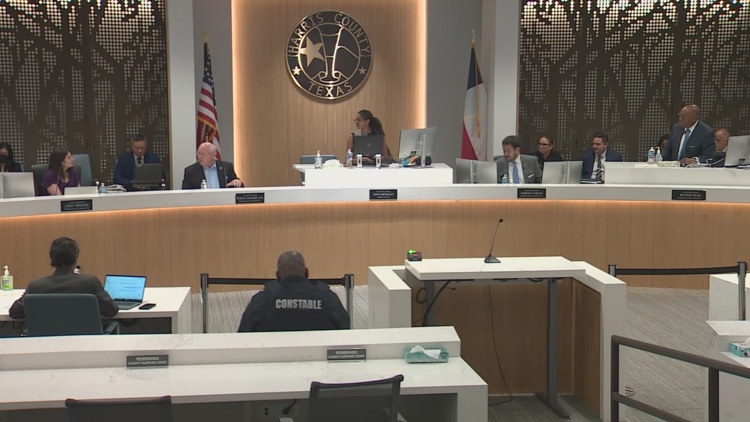

Recently, Harris County officials made the decision to raise property taxes in order to help with recovery efforts following multiple disasters, including the May derecho and Hurricane Beryl in July. The increase, announced by Harris County Judge Lina Hidalgo at Commissioners Court, is set to apply only to the 2024 tax year.

While the usual limit for tax hikes without voter approval stands at 3.5%, the exception granted due to the disasters has allowed for an 8% increase. For homeowners with a property valued at $400,000, this means an additional $160 added to their property tax bill for the year.

This decision, though not taken lightly, is seen as a necessary step to aid in the recovery efforts and ensure the county can continue to provide essential services to its residents.